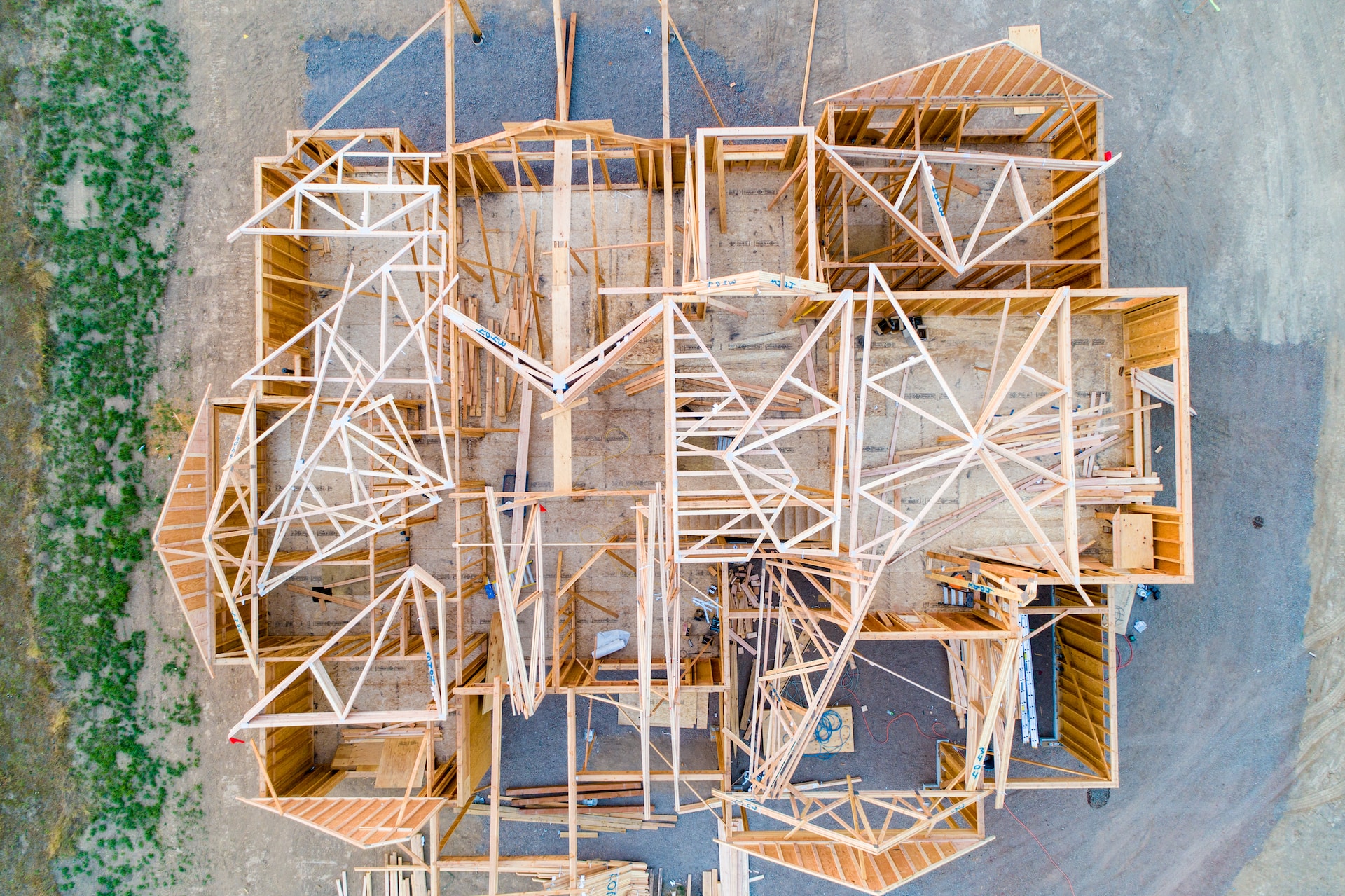

Building a home? A home construction loan can pave the way. It’s not just another loan; it’s your dream’s foundation. This special loan finances your home’s creation, brick by brick. But, just like a blueprint, understanding its details is crucial. Before laying the first brick, it’s wise to grasp these nuances. Dive in prepared, and watch your dream home rise smoothly.

Types of Home Construction Loans

Construction-to-Permanent Loans: Like a two-in-one deal. Start by funding your build. Once done, it smoothly shifts to a regular mortgage. It’s a seamless way to finance your home’s entire journey.

Construction-Only Loans: A short-term friend. It funds your build, but that’s it. After construction, you’ll refinance or get a new loan. It differs from the two-in-one perk of construction-to-permanent loans.

Owner-Builder Loans: DIY enthusiast? This is for you. It’s tailored for homeowners taking the construction lead. But be ready; you’re the boss, and it comes with its challenges.

Renovation Loans: Got an old home needing a glow-up? Enter the renovation loan. It’s perfect when buying a fixer-upper or sprucing up your current space. Make the old shine like new.

How Construction Loans Work

Interest Rates: They’re a tad different here. Unlike regular home loans, these can change. You might encounter:

- Variable Rates: They can move up or down based on market trends.

- Fixed Rates: Set in stone, they stay the same throughout.

Draw System: Think of it as a payment plan for building. Money gets released in stages, matching each construction phase. It’s smart. It ensures your builder stays motivated and pockets the right amount on schedule.

Timeline: Typically, these loans last around a year. But what if hammers stop and cranes pause? Delays can cause hiccups. If construction stalls, you might need extensions or face extra costs. Always plan ahead!

From start to finish, my experience with BuilderLoans.Net was impeccable. Their team was responsive, and the loan terms were clear and fairAmanda J., New Homeowner

BuilderLoans.Net transformed my apprehensions into confidence. With their expertise, I was able to navigate the loan process effortlessly, and now I’m watching my dream home take shape.Darren LProud Home Builder

In an industry rife with complexities, BuilderLoans.Net stands out with its straightforward approach. Transparent, reliable, and professional – they are truly the bestNina S.

Benefits of Home Construction Loans

Customization: Ever dreamt of that perfect bay window or a cozy breakfast nook? With these loans, you’re the designer. Craft each corner, ensuring your home feels uniquely yours.

Growing Equity: Here’s some magic! As you build, your home’s value might soar higher than your costs. This can boost your equity, giving you a financial upper hand.

Better Rates: The housing market’s rates might be climbing. But with construction loans, you could lock in a rate that’s friendlier to your wallet. A savvy move for the money-wise!

Challenges and Considerations

Tight Qualifications: The bar’s set higher here. Compared to regular home loans, lenders look closer at your credit and plans. Make sure you’re ready to clear that hurdle.

Building Hiccups: Not all goes as planned. Delays can sneak in. Sometimes costs shoot up unexpectedly. It’s a journey, with potential bumps along the way.

Blueprints & Builders: It’s not just about money. Lenders want to see your home’s roadmap. A clear, detailed plan is a must. And don’t forget the builder! Choosing a reputable one is key. Vet wisely and build with confidence.

Qualifying for a Home Construction Loan

Down Payment:

Expect to pay a bit more upfront. Lenders often ask for heftier percentages here.

Unlike regular loans, this initial chunk ensures you’re seriously invested in the build.

Credit Score Check:

Lenders peek at those numbers closely. A solid score? It unlocks better loan terms.

Balancing Act – Debt-to-Income Ratio:

Lenders eye your debts and earnings. They want to ensure you can handle loan repayments without breaking a sweat.

Blueprints in Detail:

Think of it as your home’s story. Lenders want a clear picture, chapter by chapter.

It’s not just walls and roofs. They’ll want to know materials, contractors, even timelines. The clearer the plan, the smoother the approval process.

Choosing the Right Builder/Contractor

Research Matters:

Don’t skip this step. Dig deep. A good builder can make or break your dream home. It’s worth every second you spend researching.

Questions Galore:

Ask and ask some more! Some starters: “How long have you been building?”, “Any recent projects I can see?”, or “How do you handle unexpected challenges?”

Past Tales Tell:

Always check references. Previous clients share real stories. Also, take a tour of their past projects. The work speaks for itself. If it shouts quality, you’re on the right track!

Tips for a Smooth Home Construction Loan Experience with BuilderLoans.Net

Paperwork in Place:

With BuilderLoans.Net, keeping every document tidy is key. A well-organized file can speed things up!

Talk Often:

Make your builder your new chat buddy. Regular check-ins ensure you both stay on the same page.

Plan for Surprises:

Budgets can be tricky. Always set a little extra aside. Those unexpected costs? You’ll be ready.

Stay On Top:

With BuilderLoans.Net, you can easily monitor loan draws and the build’s pace. Stay active, and watch your dream home rise without a hitch!

Frequently Asked Questions

The realm of home construction loans can generate a plethora of questions, especially for first-time applicants. To help streamline your understanding of BuilderLoans.Net’s offerings, here are answers to some frequently asked questions:

FAQ

Most frequent questions and answers

What makes BuilderLoans.Net’s construction loans different from other financial institutions?

BuilderLoans.Net prides itself on offering competitive interest rates, swift approval processes, and unparalleled customer support. Their digital-first approach ensures a seamless application experience, and their expertise in the construction domain makes them a preferred choice for many.

What is the minimum credit score required to be eligible for a loan with BuilderLoans.Net?

While BuilderLoans.Net evaluates various factors beyond just the credit score, a general guideline is a score above XYZ (specific number to be provided by BuilderLoans.Net). However, it’s always recommended to consult with their loan officers for a precise understanding.

Can I use the construction loan for renovations or extensions to my existing home?

Yes, BuilderLoans.Net offers loans that cater to significant renovations or extensions. The terms and conditions might vary, so discussing specific needs with a loan officer can provide clarity.

How long is the typical loan term for a construction loan with BuilderLoans.Net?

Typically, construction loans from BuilderLoans.Net are designed to last through the duration of the construction process, which could range from 6 to 12 months. However, specific durations might vary based on the project’s complexity and scale.

Are there any penalties for early repayment of the loan?

BuilderLoans.Net aims for transparency with its clients. While some loan structures might have early repayment penalties, others might not. It’s essential to read the loan agreement or discuss this with your loan officer.

How are the funds disbursed throughout the construction phase?

Funds are typically disbursed in draws, corresponding with various construction milestones. This ensures that the builder gets paid as different phases of the project are completed, aligning the loan disbursements with the construction’s actual progress.

Call to Action

Building your dream home should be an exciting, fulfilling journey, not one bogged down by financial complexities. With BuilderLoans.Net by your side, you’re equipped with a partner that understands the intricacies of construction financing and is committed to making your vision a reality.

???? Ready to Build Your Dream?

Don’t wait for tomorrow to lay the foundation for your future. Visit BuilderLoans.Net today to explore the best construction loan options tailored just for you.

???? Have Questions?

Our team of dedicated loan officers is eager to assist and guide you every step of the way. For personalized support or inquiries, reach out to us at:

- ???? Phone: 415-800-2190

- ???? Email: Info@BuilderLoans.net

- ???? Office: 6518 Lonetree Blvd., Suite 1058

Rocklin, CA., 95765

Remember, every great structure starts with a solid foundation. Let’s build yours together. Apply Now on BuilderLoans.Net and take the first step towards constructing your dream home!

Conclusion

Building your dream home is an exciting journey, and home construction loans play a pivotal role in this adventure. With various benefits, they surely shine, but as with any venture, there are challenges too.

Before laying the first brick or choosing that perfect shade of blue for your kitchen, it’s vital to understand the nuances of these loans. Their perks, their pitfalls, and everything in-between.

So, as you stand on the brink of this exciting endeavor, take a moment. Weigh the pros and cons. And remember, there’s no harm in seeking wisdom. Consulting with financial advisors or loan experts can offer clarity, ensuring your home rises on a foundation as firm as your understanding.

Here’s to informed choices and the joy of crafting a space truly yours. Happy building!